Drawing inspiration from Dickens' A Christmas Carol, Bryan Bann explores how you can enjoy the holidays now without sacrificing your future.

This is a div block with a Webflow interaction that will be triggered when the heading is in the view.

After months of threats and ‘will they, won’t they?’, Russia has invaded Ukraine. Russian president Putin has denied this is an occupation, instead calling it a “special military operation” to “demilitarise” Ukraine. Many other countries see it differently though, with US president Biden calling it “premeditated war that will bring catastrophic loss of life and human suffering”.

Most will agree this is a troubling scenario that could potentially lead to a larger conflict if other nations become involved. Many investors, however, will no doubt be left wondering what impact this could have on their portfolios, and whether they should be doing anything about it.

It’s almost impossible to really know what impact the Russia-Ukraine conflict will have on markets, given no-one knows how events will unfold. It is likely, however, that an event that has attracted so much media attention as this could cause some short-term wobbles. Over the space of days, weeks and months, markets can be affected by sentiment. If investors turn nervous, as they may become with recent events, we could see falls.

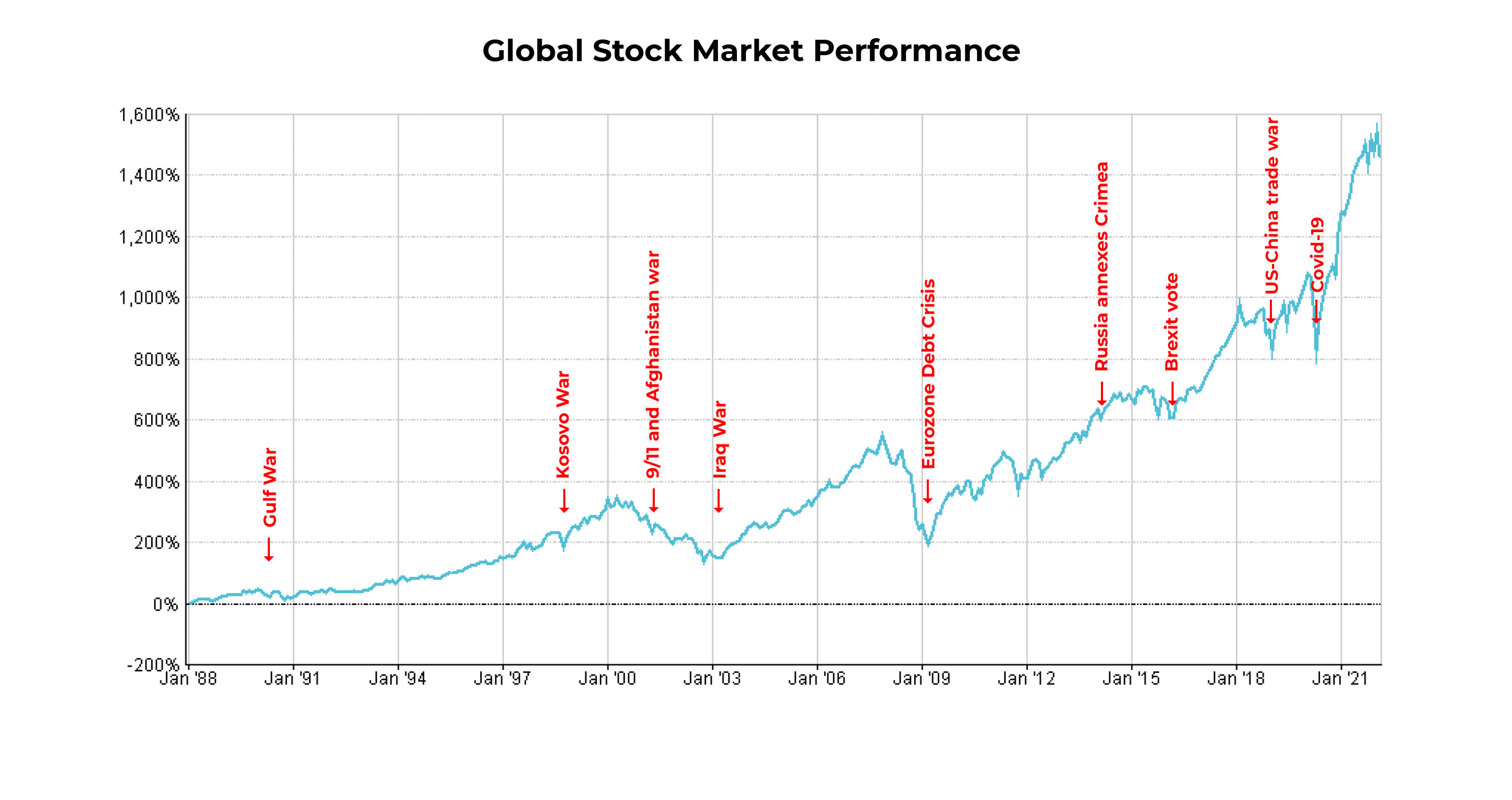

The same thing happened after the start of other front-page events, such as the 9/11 attacks, Afghanistan and Iraq wars, Eurozone debt crisis, Brexit, ex-US president Trump’s trade war with China and more recently Covid.

As time goes by, however, the impact of these events tends to be diluted by long-term performance. It doesn’t matter how severe they may have appeared at the time, given long enough their impact on markets almost always fades away into insignificance.

We’re not downplaying the potential seriousness of the events in Ukraine, but from an investing point-of-view the potential impact on markets is certainly not unprecedented. There have always been flash-point scenarios with the potential to rock markets, and there likely always will be. Rarely do they have a lasting impact on long-term investors though.

Some investors may be tempted to tinker with their investments in response to the Russia-Ukraine conflict. We think that would be a mistake. Given the unpredictable nature of the event, any changes made could end up doing more harm than good to your returns, if things don’t pan out as expected.

You could of course correctly guess the outcome, but then get the market reaction wrong. Don’t forget market fluctuations are not just driven by geopolitics – they’re affected by an almost infinite number of factors. So even if the situation in Ukraine does deteriorate, there’s no guarantee that the markets will suffer the same fate.

Some investors have also mistakenly pinned the blame for market falls since the end of 2021 on the Ukraine conflict, given the build-up of Russian troops on the Ukrainian border began at around the same time. The recent falls are in fact likely largely due to expected interest rate hikes across many parts of the world in response to rising inflation.

While we also don’t think short-term market falls justify changes to a long-term investment plan (more on that in just a moment), we certainly don’t think portfolios should be changed in response to something as unpredictable and potentially irrelevant to long-term returns as the current Ukraine invasion.

By now you’ve probably figured out we’re not going to be making any knee-jerk reactions to Russia’s invasion. It’s very difficult to know what changes to make in response to something with such an array of potential outcomes. More importantly though, we believe the key thing to focus on is the long-term returns of your portfolio, not the short-term ups and downs.

History has shown that the best investment results are often achieved by remaining calm in the face of market volatility and sticking to your investment plan. If you feel the need to chop and change every time there’s volatility or the potential for it, you might want to reassess your tolerance for risk. Volatility is a very normal part of investing, and investors are usually rewarded for accepting volatile performance.

While we’ll be monitoring the situation in Ukraine, we won’t be adjusting our portfolios in response to it or any other short-term event. That includes the recent market falls. While of course disappointing, we recently conducted a formal review of all the funds within our portfolios and remain happy with their long-term performance potential.

That doesn’t mean the portfolios are set in stone. We’ll never make changes for change’s sake, but over time we expect to make some as we’re always looking to deliver the best long-term returns within a level of risk you’re comfortable taking. That’s always been the case and will remain so whatever the outcome in Ukraine or any other events the future has in store.

Ordered list

Unordered list

Ordered list

Unordered list